snohomish property tax payment

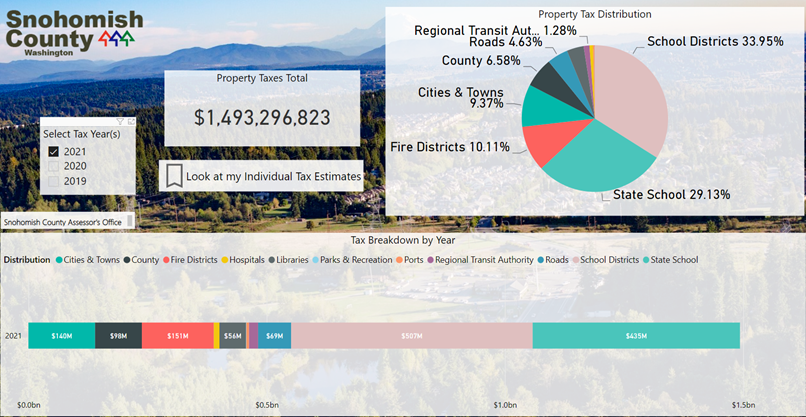

Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11 and slightly below the Washington statewide average of 092. The following links maybe helpful.

News Flash Snohomish County Wa Civicengage

Taxes Tax Rates and Information For rate questions visit Washington State Department of Revenue or call 800-547-7706.

. Online City Utilty Payments. Use My Location Everett. Treasurer Tax Collector Offices near Everett.

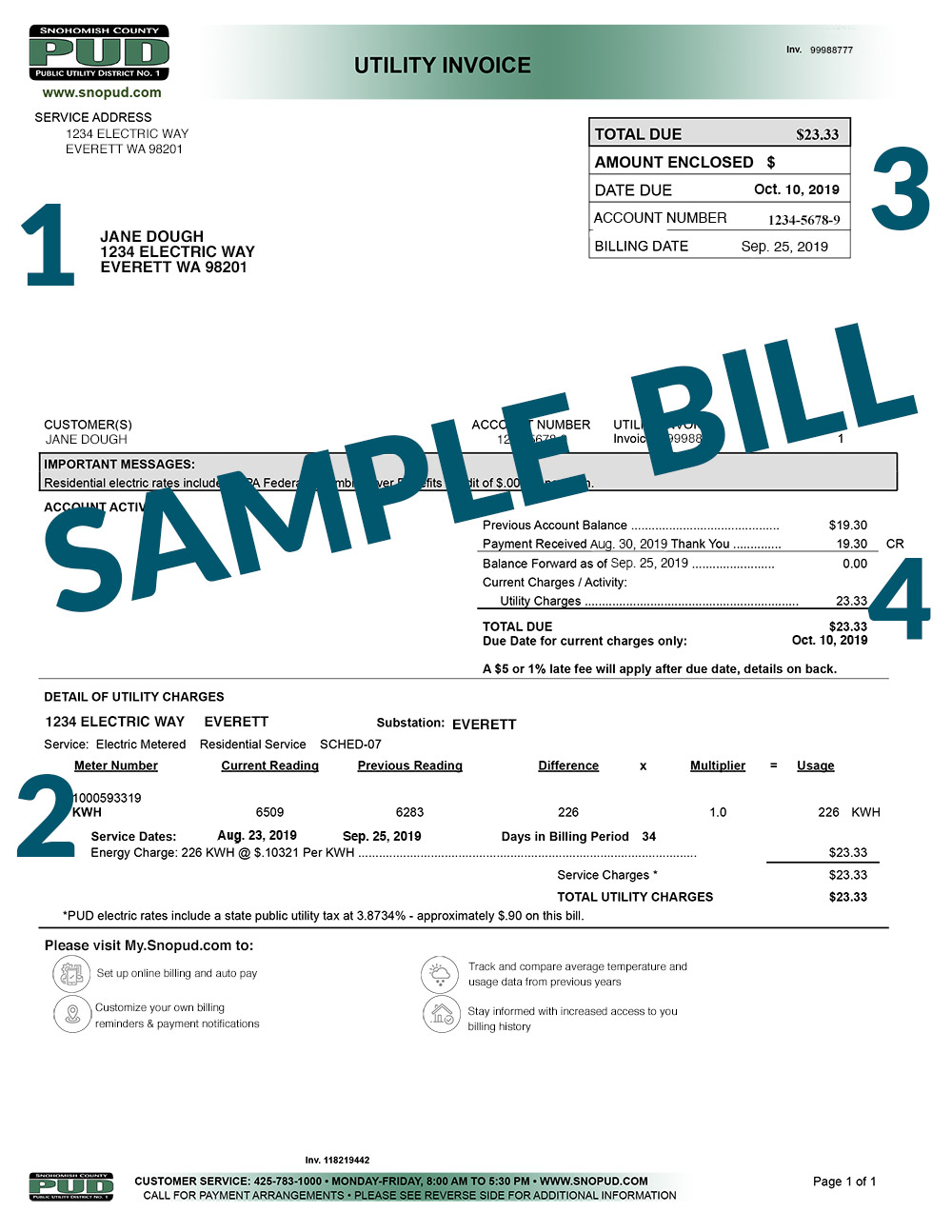

Using this service you can view and pay them online. Median Property Taxes No Mortgage 3534. 1-Utility Bill Payment 2-Payments for PBIA Fee Park Rentals Special Event Fees NO UTILITY PAYMENTS.

Make check or money order payable to. Snohomish WA 98291-1589 Utility Payments PO. Please refer to the back of your tax statement to determine eligibility or you may contact the Snohomish County Assessors Office at 425-388-3540 for additional information.

Please include your PUD bill payment slip to avoid any delays in processing your payment. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone. Snohomish County collects on average 089 of a propertys assessed fair market value as property tax.

PO Box 1589 Snohomish WA 98291 360-568-3115 Terms and conditions Contact us. Find All The Record Information You Need Here. To get help with online payments either email the treasurer with your question or call customer service at 425-388-3366.

Please note that 1st Half Taxes are Due April 30th and 2nd Half Taxes are Due October 31st. Receipts are then dispensed to associated taxing units via formula. I have read the above and would like to pay online.

Help with Online Payments. Due to the financial hardships caused by the COVID-19 pandemic Snohomish County Treasurer Brian Sullivan and Executive Dave Somers have extended the first-half 2020 property tax deadline to June. There are three primary phases in taxing property ie devising levy rates assigning property market worth and receiving receipts.

Snohomish County Property Tax Payments Annual Snohomish County Washington. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600.

Median Property Taxes Mortgage 3638. Snohomish County Assessor 3000 Rockefeller Avenue Everett WA 98201 Phone. The Assessor and the Treasurer use the same software to record the value and the taxes due.

Once you have registered for a Paystation account you can instantly access and manage your bills from Snohomish County. Stay logged in. Check money order cashier check.

Welcome to the City of Snohomish online credit card debit card and e-check payments portal. Snohomish Boys. Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706.

We are now accepting credit card payments in-house along with online. Ad Unsure Of The Value Of Your Property. Please select below the type of payment you are making.

Please note that 1st Half Taxes are Due April 30th and 2nd Half Taxes are Due October 31st. Snohomish County Treasurer 425-388-3366. You will need a current statement from Snohomish County to create an account.

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone. Get Record Information From 2021 About Any County Property. Use the search to locate and pay your bill with Quickpay instead.

Securely make a payment with a credit card debit card or by eCheck. Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706. What is the property tax rate in Snohomish County.

If paying after the listed due date additional amounts will be owed and billed. PO Box 1100 Everett WA 98206-1100. Pay for services online.

The Treasurers office will give a grace period for seniors and qualifying disability renewal applications for property tax exemptions. Search for Property Taxes. You must have an existing account before you can sign in with Google.

If paying after the listed due date additional amounts will be owed and billed. Snohomish County has one of the highest median property taxes in the United States and is ranked 155th of the 3143 counties in order of. Other Places to Pay with Credit Cards.

Taxing authorities include Snohomish county governments and numerous special districts like public schools. Based on that 089 rate Snohomish County homeowners can expect to pay an average of 3009 a year in property. 425-262-2469 Personal Property.

Using this service you can view and pay them online. Use the search tool above to locate your property summary or pay your taxes online. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

Your bill comes with a self-addressed return envelope for your convenience. Make a one time payment below using your Parcel ID OR use the Create an account link to make future payments easier. Prefer not to login.

Snohomish WA 98291-1589 Utility Payments PO. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone.

News Flash Snohomish County Wa Civicengage

Individual Property Tax Deadline Extended To June 1 Lynnwood Times

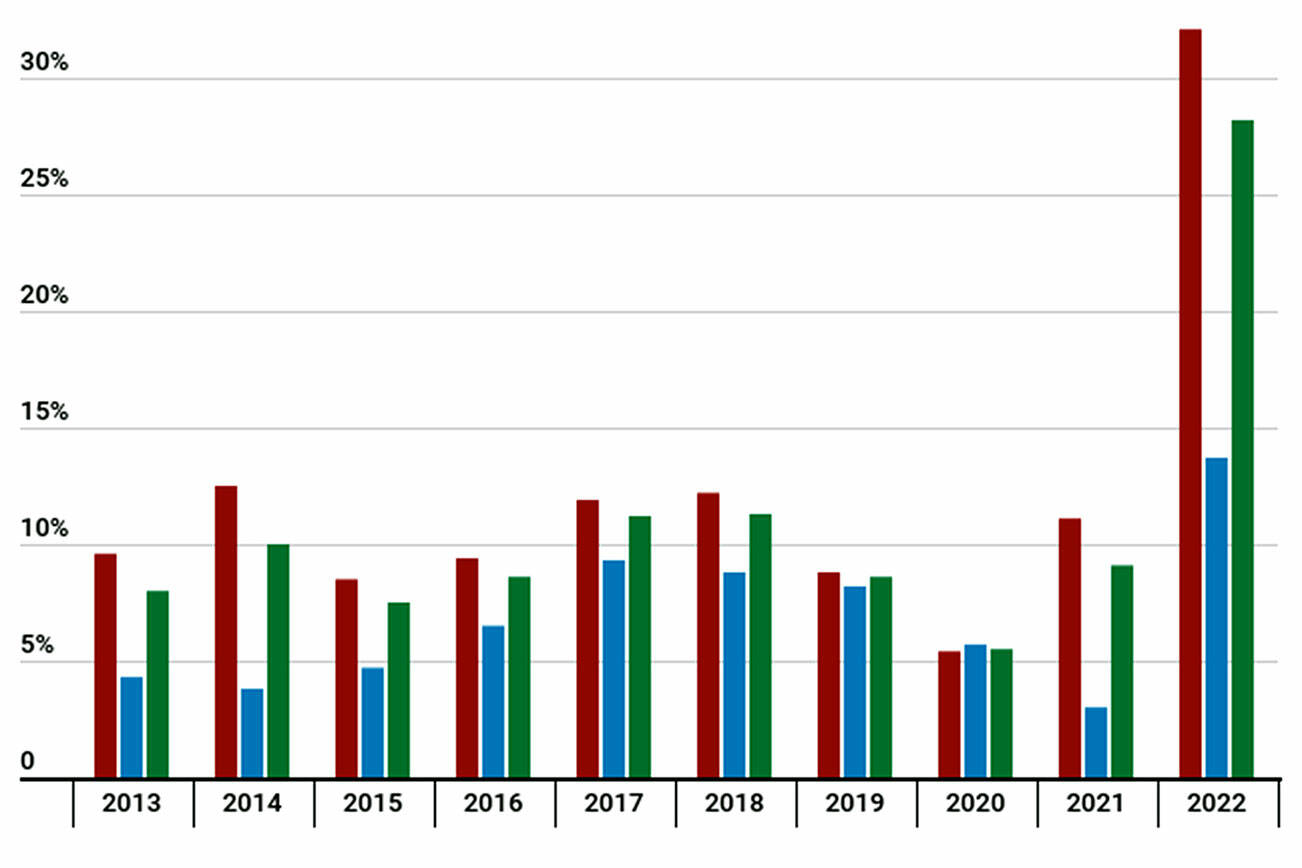

Property Values Soar 32 In Snohomish County Due To Hot Housing Market Heraldnet Com

My Billing Statement Snohomish County Pud

Snohomish County Wa Official Website

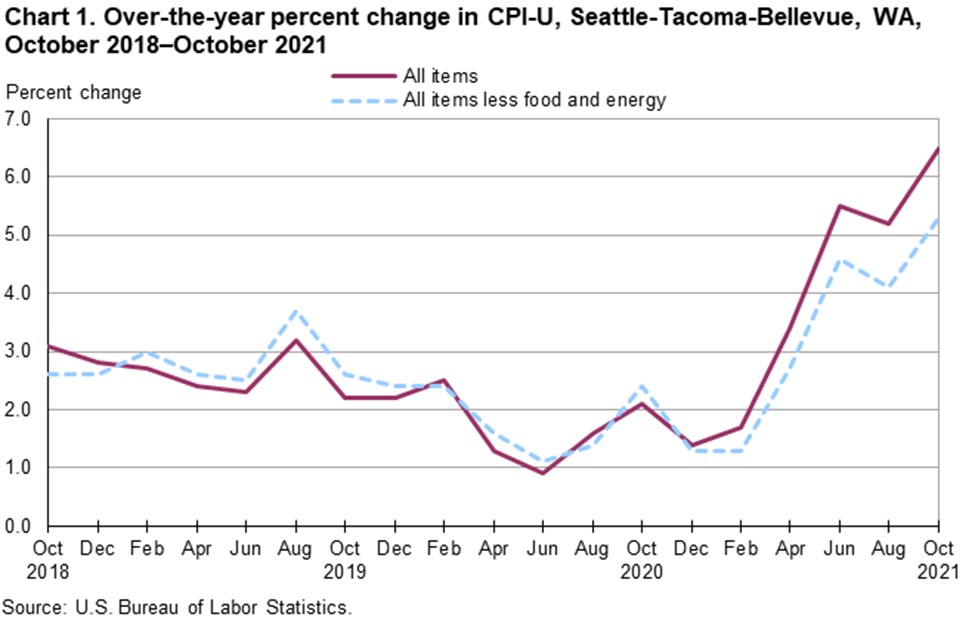

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Assessor Snohomish County Wa Official Website

Logging In Snohomish County Wa Official Website

Snohomish County Property Tax Exemptions Everett Helplink

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Tax Payment Options Snohomish County Wa Official Website

How To Read Your Property Tax Statement Snohomish County Wa Official Website

By The Numbers Largest Taxpayers In Snohomish County Heraldnet Com

Homeowners Worry As Snohomish County Property Taxes Rise Over 34 In 5 Years